You need to know if you can afford to spend your time traveling, pursuing recreational activities, doing charitable work, purchasing a vacation home, or just spoiling your grandkids! Simply put, you want to maintain your chosen lifestyle and NOT run out of money.

Whether you are old or young, retired or still working, there are a number of additional questions that complicate this decision.

These Questions Include:

- How much money do I need for retirement?

- At what age can I afford to retire?

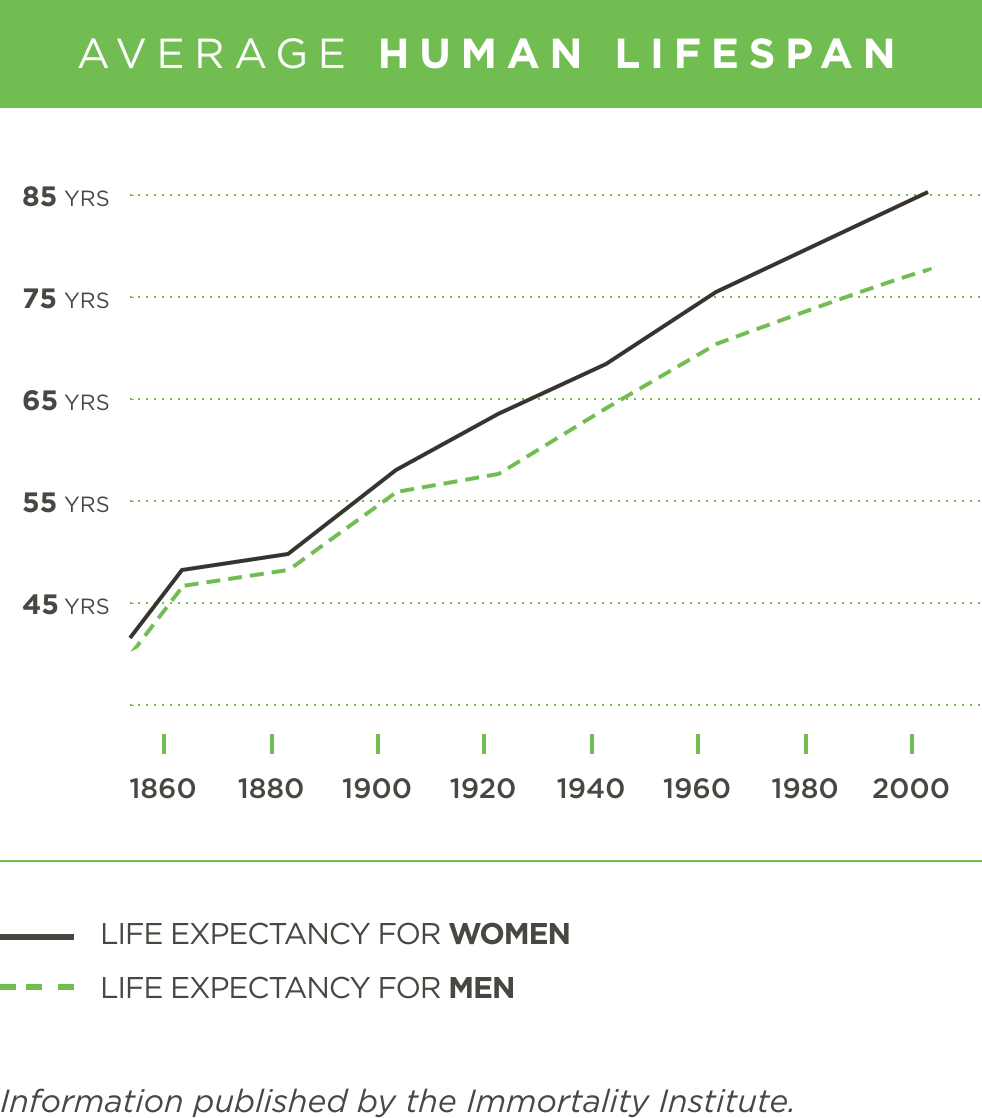

- How long am I going to live?

- How much can I afford to spend each year during retirement?

- What impact will inflation have on my retirement?

- How do I make my retirement money last as long as possible?

The answer to some of these questions requires a safe, steady, predictable income to replace the income that was previously supplied by your chosen career. To ensure a safe, predictable income, you must put some of your money into fixed-income investments. These investments however, will not yield sufficient returns for those distant years that you must leverage so you don’t run out of money later in retirement.

The answer to the rest of the questions requires investments that give you the greatest potential for growth but aren’t necessarily designed to provide safe, steady, predictable income. You certainly can’t put all of your money into aggressive investments that could go way up, but could also go way down, risking your sacred retirement money.

How the Bucket Bliss strategy works