“How can I insure that the money I need in the near term is safe and predictable, and not subject to the day-to-day market fluctuations, while I simultaneously put myself in a position to receive the long-term market returns required to provide an increasing income stream throughout my entire life?”

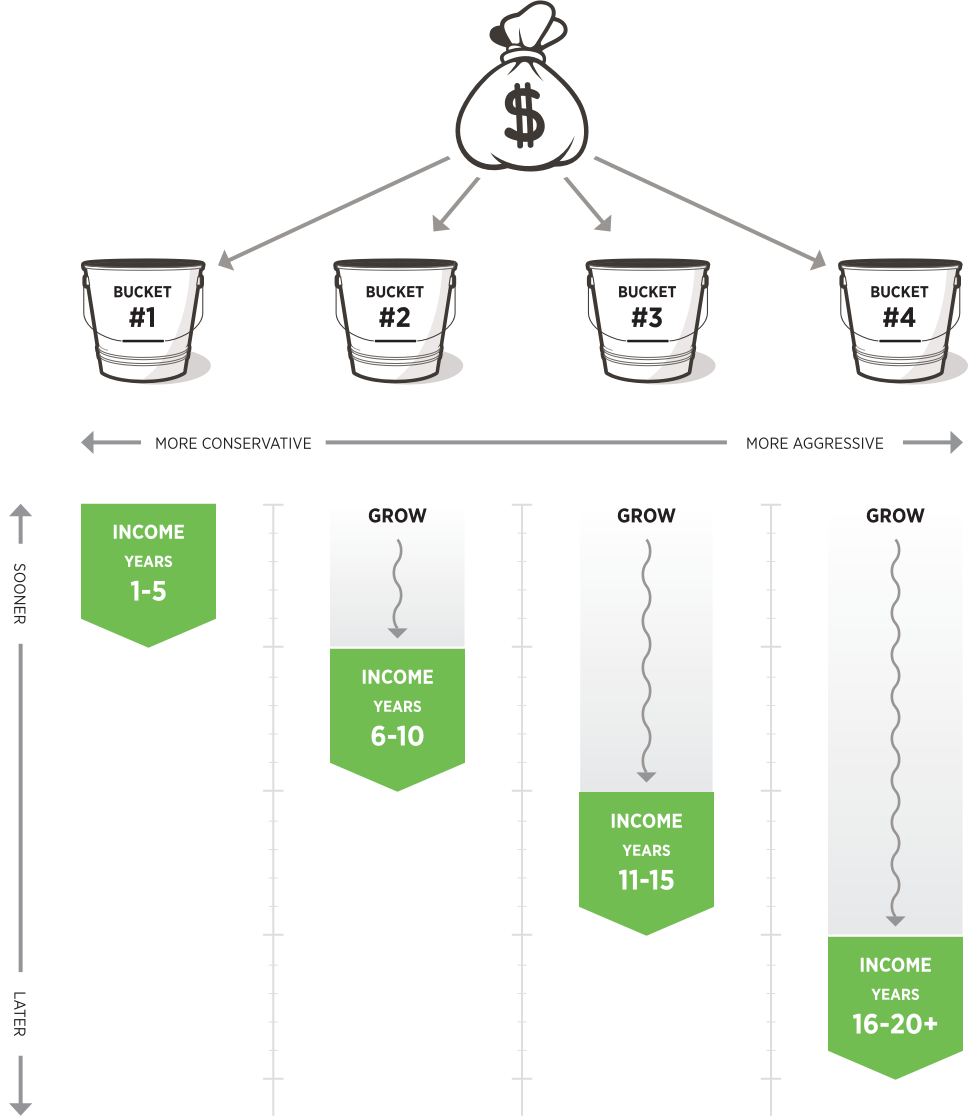

The Bucket Bliss Strategy creates “buckets” of investments appropriate to the time frame in retirement in which the income need is anticipated.

Here is how the different buckets work.

The Bucket Bliss Strategy is not a one-time hit. It’s a fluid, adaptive strategy that has been repeated again and again. It’s designed to give you the retirement income you’ve worked so hard for. But it’s not a generic strategy you can easily implement by yourself. It’s tailored to your goals, your objectives, and your financial situation by a financial advisor who can put a plan in place to make your retirement dreams come true. No doubt your plan will need adjusting over time as the market swings, inflation fluctuates, and your lifestyle changes. A professional financial advisor can ensure your Bucket Bliss plan stays on track.

These basic concepts help you maximize your retirement income and avoid the two most common problems you face in your retirement years: spending too much and running out of money before you run out of life, or spending too little and foregoing opportunities that would have provided you with a full and abundant life during your retirement.